Highest issuance in 14 years with higher credit quality too

An unexpected side effect of the pandemic has been the extraordinary rise in home prices during 2021. That has increased the need for jumbo loans — mortgage loans that exceed the loan limits of Fannie Mae and Freddie Mac.

When mortgage rates dropped at the onset of the pandemic in 2020, the effects were felt immediately in the market for conforming loans — mortgages that can be packaged into federally backed mortgage securities. Mortgage rates on jumbo loans were slower to come down and reached an all-time low during 2021. Analysis of CoreLogic public records showed that 2021 had the largest dollar volume of jumbo loan originations since 2005 due to record-low jumbo interest rates and ever higher home values.

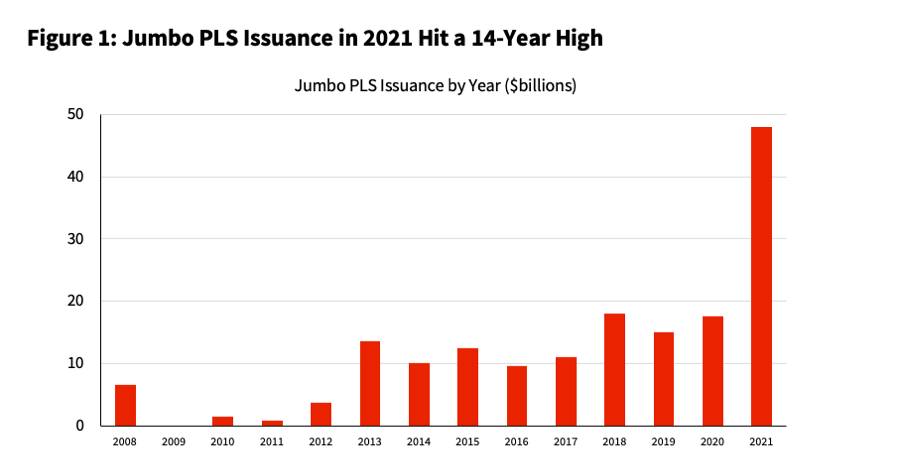

While many jumbo loans are held in bank portfolios, some are placed in private-label securities. Jumbo loan securitization more than doubled in 2021 from the prior year and was the largest issuance since 2007.

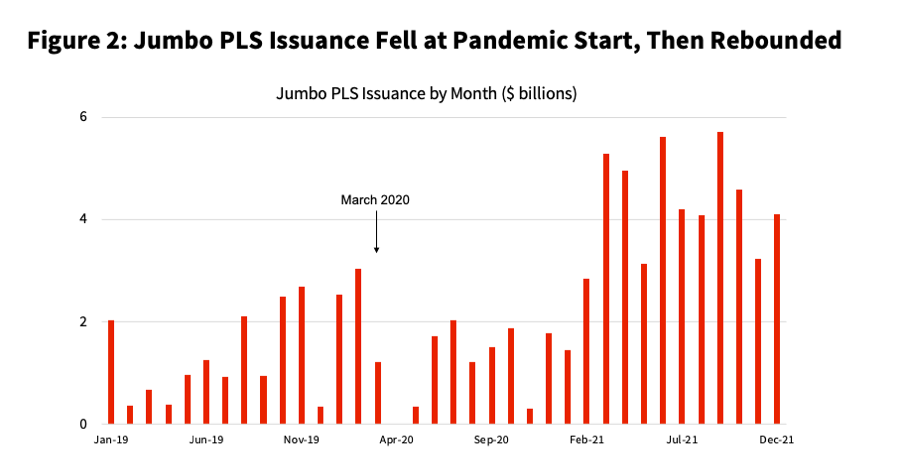

The resurgence in jumbo securitization is noteworthy given the temporary dearth of issuance when the pandemic began. Issuance dried up in April 2020, and May of that year saw only about one-tenth of February’s volume. Volume picked up starting in the summer of 2020 before taking off in 2021.

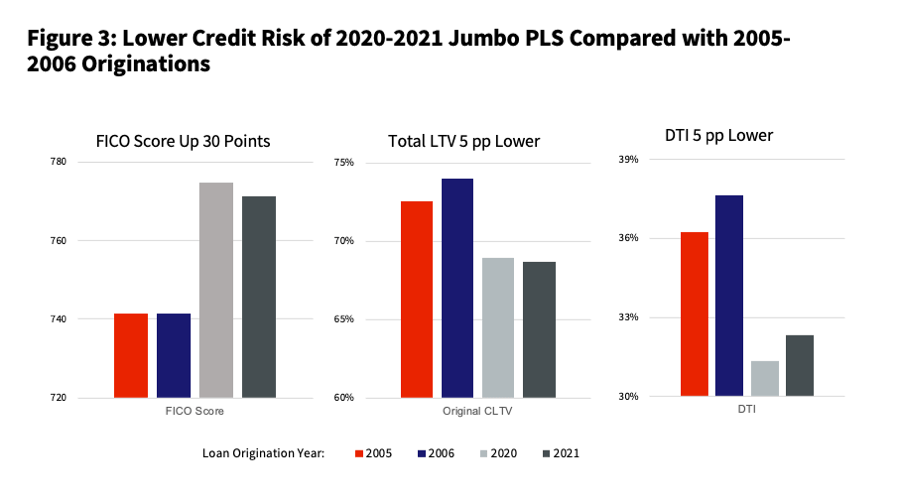

Credit quality of the jumbo loans packaged in today’s securities is far higher than those that were securitized during the housing bubble of 2005 and 2006. When compared to housing bubble borrowers, borrowers whose jumbo loan was securitized in 2021 had, on average, a credit score that was 30 points higher and a loan-to-value ratio and a debt-to-income ratio that were each 5 percentage points lower.

We expect jumbo loan originations and securitization in 2022 to be less than last year for three reasons.

First, the conforming loan limit was raised 18% at the start of 2022, shrinking the jumbo loan market. Second, the CoreLogic Home Price Index Forecast projects a moderation in price gains during 2022, thus slowing the jumbo market expansion during the year. Finally, higher mortgage rates in 2022 will reduce jumbo refinance.

Summary:

- Record-low jumbo loan rates and rapid home price growth increased jumbo lending in 2021.

- The start of the pandemic in March 2020 temporarily stopped jumbo security issuance.

- Jumbo loan securitization doubled from 2020 to 2021, reaching the largest volume since 2007.

- Due to higher credit scores, lower LTV and lower DTI, the jumbo loans securitized from 2020-2021 had lower credit risk than the loans securitized during the 2005-2006 bubble.

Acknowledgment: Patrick Kiser obtained the data for the figures from CoreLogic Vector Securities.

Methodology Note:

In CoreLogic VectorTM Securities, jumbo mortgage-backed securities (MBS) are characterized by loans that have a loan balance greater than the current Freddie Mac and Fannie Mae conforming loan limit. These pools may also contain conforming loans that the issuer decided not to sell to Freddie Mac or Fannie Mae. The loans in these pools are, in general, made under a traditional set of underwriting guidelines to borrowers with good to very good credit. The following characteristics are typical of jumbo MBS pools:

- Very high percentage of full doc loans (> 75%)

- Very low percentage of non-owner-occupied properties (< 6%)

- High weighted average FICO (> 700)

- Low weighted average coupon (depends upon loan age and when issued but less than ALT-A or sub-prime deals)

- Low weighted average margin for ARM loans (typically < 3%)

The prospectus supplement for the related deal indicates nothing unusual about the collateral related to underwriting standards and/or collateral risk. In addition, most prime loans are made by well-known national prime lenders.

2022 CoreLogic, Inc. , All rights reserved.